By: Dana Leigh Cisneros, Esq.

November 17, 2021

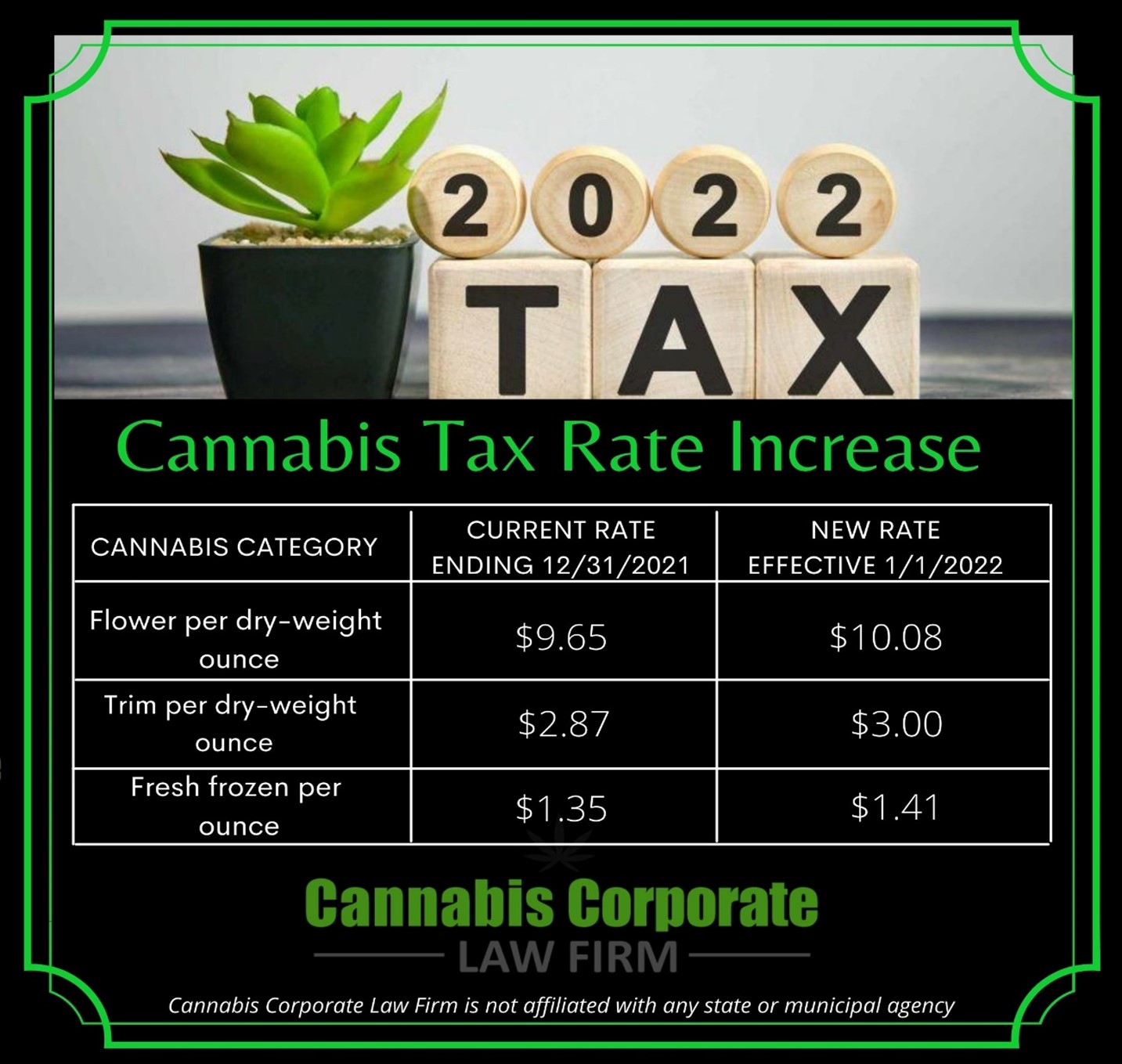

The cultivation tax rates are going up again for 2022. Cultivators will now pay $161.28 per pound of flower, $48 per pound of trim and $22.16 per pound of fresh frozen. While the law requires an increase for inflation (go here and download the CPI excel sheet – CFTFA uses June 2020-June 2021 to determine the increase), we are pretty shocked that in response to reports of plummeting prices and market saturation that the State would respond by INCREASING the cultivation tax.

What are our outdoor cultivators supposed to do? Way to kill craft cannabis just in time for 2023 when the big corporations will show up to buy all the farms. To sell an $800 pound of outdoor, the $161.28 tax amounts to a hefty 20% of the sales price. Many cultivators are using the “pass through” method of paying the cultivation tax, which means that manufacturers and distributors need to come up with that money after paying that $800, following the prior example.

What can we do?

First, call every state representative you can and let them know you want them to sponsor a bill to reduce, if not suspend, the cultivation tax. To find your local representative, go here. The lobbyists for the larger organizations alongside grassroots activists have been trying to suspend or reduce the cultivation tax for years. They have been unsuccessful. Now is the time the industry needs to grab itself by the bootstraps and do some advocacy on its own behalf. I know a lot of folks feel like our representatives do not hear us a lot of the time, but they have to listen to all of us if we use our powerful voices. I do not want to hear the defeatist bullshit we tell each other and ourselves that our voices do not matter, because we all matter, greatly.

We are all here because we not only believe in the business of cannabis, but in the power of the plant. People are talking a lot right now about personal liberties and freedoms and the right to express ourselves. There is nothing more American than standing up to inappropriate taxes levied by the government. It is a the very core of our democracy. When we allow big business and paid lobbyists to speak our truth, we lose our power. So since these folks “representing” the industry fail to deliver, it is time to take matters into our own hands.

We have 120 members of the California legislator and every single one of them works for us. One of them is bound to be bold and daring enough to stand up to this nonsense of taxing a plant and what constitutes life saving and altering medicine.

Through correspondence with the Director of CDTFA yesterday, Mr. Maduros focused on the fact that CDTFA merely implements the law, checks the inflation rate and does the math to make the statutory adjustments to the cultivation tax rate. I agree, and the man is just doing his job. In my dealings with him and others at the top of CDTFA over the years, I have always found the Department to be transparent and willing to listen; but these are not policy makers.

But how many times have we heard from local jurisdictions or other agencies that they just did not hear from us. I think of Chula Vista that required a certain number of years of experience in alcohol or pharmacy operations to apply for a cannabis license; pretty much everything we in the industry are trying to avoid. When I asked the policy makers why, the answer was simple: those are the only people we heard from.

So while CDTFA may not have the power to change the tax rate, you can believe that if they are asked and they reply with no one objected, the State is going to use that as justification to continue increasing the taxes as trillions of dollars continue to be pumped into our society.

You can contact the CDTFA and let them know you are opposed to this increase and is unsustainable here in California by emailing them through the portal here.

Luckily the cannabis mark‑up rate will remain at 80 percent through at least June 30, 2022. However, if retailers meet these increased cultivation taxes with increased prices, we an expect the mark-up rate to increase as well. So far, CDTFA has only raised the tax once since 2018 from 60% to 80%.

Leave A Comment